Financial Advisor Services provide a powerful tool in the Financial Services industry; a tool capable of solving many of the problems facing Advisors in today’s economy.

Determined to be the conduit to solve Advisors problems, our goal is to be known as the #1 resource that Financial Advisors turn to for just about any issue facing their practice. These issues include practice management, practice valuation, or sale, as well as the technology you need to remain competitive. We cater to Registered Investment Advisors, Independent advisors, insurance professionals & wirehouse reps.

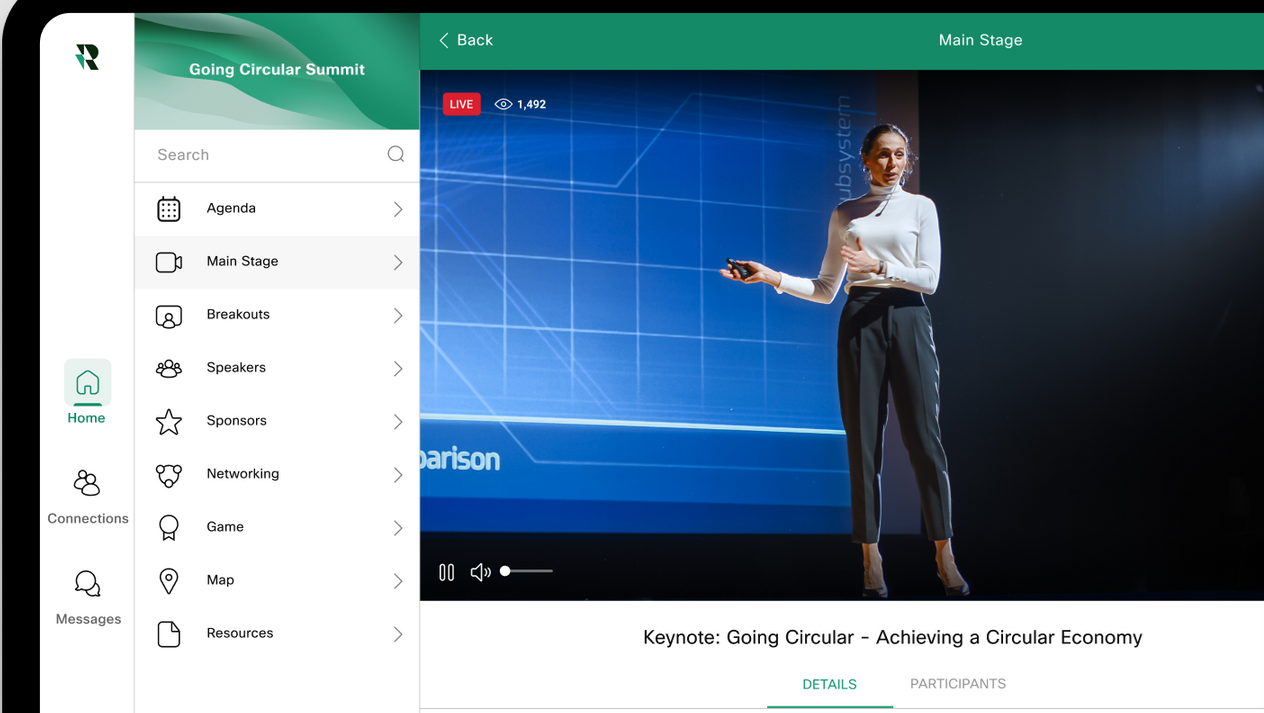

Our system works by matching Advisors’ needs & wants with experienced professionals in the Financial Services industry. We bring these professionals together several times a year at our Advisor Conferences in Arizona, Colorado, and southern California.